Cash flow forecasting: do I need it?

29th June 2022

Cash Flow Forecasting: Do I Need It?

Profit and Cash Flow

You may already monitor your profit and assume that because you are profitable, you are cash-rich. Perhaps you are. Perhaps not..?

Accounting is like a dark art; it was created to make people who are not accountants think that accountants are wizards, because they can see things the ‘ordinary human’ can’t. Yes, you are making a profit and that’s brilliant! But wait, your wizard (accountant) has spotted something in your balance sheet (that mysterious area of accounting that wizards use to mystify non-wizards) suggesting you may not be doing as well as you think.

After you’ve had time to digest the information, you realise that you are making ‘£x’ profit each month, but your bank balance is remaining flat. It isn’t increasing in line with the profit you are making. Or worse, it is decreasing.

You ask your wizard to explain how this could be without using rabbits, hats and card tricks. They tell you that profit is like chalk and cash is like cheese. They are not comparable.

Profit (Chalk)

The things that go into making up your profit are things like sales invoices to customers, purchase invoices from suppliers, or expense claims from employees. The date of these transactions determines which period they impact your profit. They are NOT cash transactions (in most cases).

Cash (Cheese)

You have issued sales invoices to your customers. They may not pay you until the month after you issued the invoice. A disconnect between profit and cash.

You bought something from a supplier and they issued you an invoice for the goods/ service. You know you can get away with not paying them until two months after they invoiced you. But the other supplier you bought from, wants paying within a week of sending you the invoice! Differences between profit and cash.

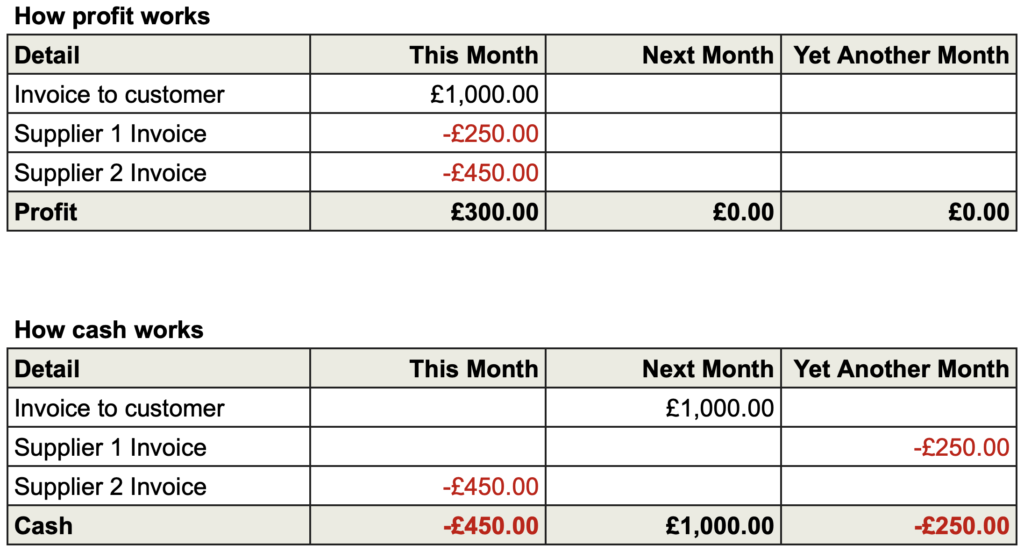

Example

Using the information from the previous paragraph, I have painstakingly created an example of how the profit and loss would look and how your bank statement would look, if you only had those three entries. From a profit perspective, things look good. However, the bank account is fluctuating.

Other Influencing Factors

Besides what has already been mentioned, there are other influences on cash flow which are not usually present in the profit and loss statement. These include:

- Loan or hire purchase payments.

- Tax payments.

- Directors’ drawings or dividends.

- Fixed asset purchases.

- Stock held by the business.

- Debtors (the people/ businesses you sell to) not paying you on time.

- Creditors (who you own money to) may be pressuring you for cash before your customers pay you.

Cash Flow Forecasting: Why Do It?

- Knowledge – information and knowledge of your future cash position is vital to run a successful business.

- Peace of mind – with knowledge comes peace of mind. Even if things don’t look as good as you’d hoped, you can now act.

- Decision making – having a good cash flow forecast enables you to make decisions, some of which you can only make with confidence when using cash flow forecasting.

- Cash is king – as discussed earlier, profit doesn’t necessarily equate to a cash-rich company. Companies who don’t monitor their cash flow, no matter their size, can fail as a result.

How To Do It?

You could use the old traditional way of using a spreadsheet. Don’t get me wrong, I LOVE spreadsheets and you can have all sorts of fun with them. But to do justice to a cash flow forecast, you need a lot of spreadsheet skill and a good dose of time; not just to create it but to keep it up to date.

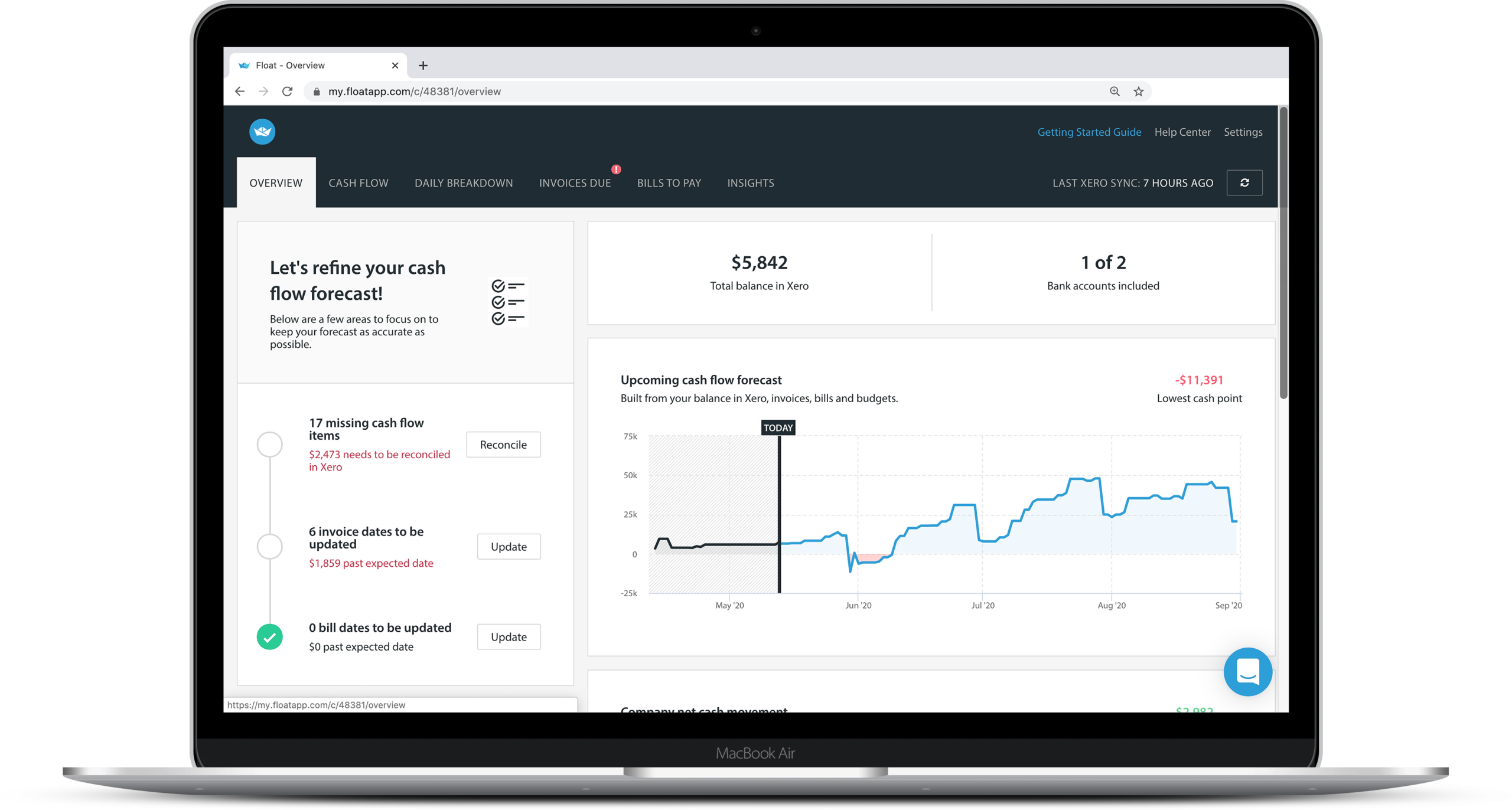

I use Float, a tool which links with Xero, QuickBooks or FreeAgent. To go back to my ‘wizard’ analogy, it is like a wizards’ assistant. It does a lot of the work for you and makes your life easier. You can do scenario planning with it and monitor your cash against budgets, too.

If you are interested in using Float or discussing cash flow forecasting further, please get in touch. It might just keep your business afloat (da-dum-tish).