Uncategorised

An Introduction to Google Sheets

12th January 2023

An Introduction to Google Sheets

What is Google Sheets

Google Sheets is a web-based spreadsheet application that allows users to create and edit spreadsheets online. Developed by Google, it is part of the Google Drive suite of productivity tools.

Collaboration Features

One of the key features of Google Sheets is its ability to collaborate in real-time. This means that multiple users can work on the same spreadsheet at the same time, making it an ideal tool for teams to use for projects and data tracking. Users can also share the spreadsheet with others and set different levels of access, such as view-only or editing permissions.

Advanced Features of Google Sheets

Formulas and functions

Google Sheets also offers a wide range of advanced features. These include built-in formulas and functions that can help users perform calculations and analyse data. Google Sheets also allows you to create your own custom functions.

Chart and graph creation

Google Sheets also allows users to create charts and graphs to represent data in a visual format.

Connecting to external data sources

Users can connect Google Sheets with external data sources to import data and perform analysis.

Commenting and change tracking

Google Sheets offers a feature to add and edit comments, and track changes made to the spreadsheet.

Add-ons and Integrations

Tools for automating tasks

Google Sheets offers a number of add-ons and integrations, which can be used to enhance the functionality of the application. These include tools for automating tasks, such as data validation.

Connecting to external services

Users can also connect Google Sheets to external services such as Salesforce and Google Analytics to extract data from them.

How Interpredata can help with Google Sheets

Training and support

For those who are new to Google Sheets, it may be overwhelming to navigate through all these features and options. This is where Interpredata comes in. I can help you make the most of Google Sheets by providing you with the training and support you need to effectively use the application for your business or personal use.

Data analysis

Interpredata can help users with data analysis, chart creation, and automating tasks using Google Sheets.

Dashboards

We can help users to create charts and graphs to represent data in a visual format.

Automating tasks

Interpredata can help users to automate repetitive tasks using add-ons and integrations in Google Sheets.

Conclusion

Google Sheets as a powerful and versatile tool Google Sheets is a powerful and versatile tool for creating, editing, and collaborating on spreadsheets online. Whether you are a small business owner, a student, or a part of a large team, Google Sheets can help you organise and analyse your data in an efficient and effective way.

Interpredata can help users to make the most of Google Sheets by providing training and support, and helping with data analysis, chart creation, and automating tasks.

Why bookkeeping should be a priority for small businesses

10th August 2022

Bookkeeping

The dictionary definition of bookkeeping is ‘the activity or occupation of keeping records of the financial affairs of a business.‘ That seems simple enough, but according to Clutch, a quarter of businesses still record their finances on paper and nearly half of the businesses surveyed don’t employ either an accountant or bookkeeper! When you consider how complicated accounting and taxation can be, I wonder how wise this is?

So what are some of the benefits of bookkeeping?

Budgeting & Planning

Maintaining accurate records allows you to start planning ahead; budgeting and forecasting. Once you have created your budget/ forecast, you can track your performance against it. This helps you spot patterns, errors and most importantly, opportunities.

Access to Historical Information

It is likely that at some point you (or your business) may want to apply for a grant, loan or other source of financing. Having an accurate record of your historical finances, will enable you to more easily fulfil requests from lenders who will usually ask for financial details; turnover for the prior year, profitability, liabilities, assets held by the business etc.

You will also be able to track your progress over time, or compare Q2 this year with Q2 last year for example. This is another way of identifying the performance of your business. But the key is having accurately maintained data in the first place.

Reduced Errors

By maintaining financial records you are more likely to reduce errors such as paying people twice, or overlooking amounts owed to you.

Compliance with Statutory Requirements

I can only imagine what it must be like when, let’s say, it is time to produce a quarterly VAT return but none of the information for that quarter has been recorded anywhere? It would be a scramble to get the information pulled together in a short space of time, potentially leading to errors or omissions.

Compare that stressful situation with the person who regularly records their financial transactions. All they need to do is casually check the VAT return, and submit it.

DIY or Employ a Bookkeeper?

Perhaps there’s an argument that doing it yourself is a no-brainer, nowadays. Software such as Xero, Quickbooks or FreeAgent are all being designed with the ‘non-accountant’ small-business owner in mind. They try to make things as easy as possible so you can indeed do it yourself. Automated data import from your bank, easy bank reconciliations and Making Tax Digital are pretty much standard. If you are so inclined, you can definitely run your businesses finances perfectly well using such software and with little to no assistance from anyone else.

The alternative is paying someone to do it for you. That may seem like the crazy option, especially given what I have just said about how easy it is to do it yourself. Let me provide an example.

Tools are available to enable anyone to design and create their own website and branding. I started out down that route but with ZERO design experience or more importantly, skill. I wasted hours attempting to create even the simplest of websites with the net result of nothing to show for it. How much money could I have earned in that time? How much did it cost for me to attempt something which I am not skilled at?

In the end, someone with actual design skills created my branding and this lovely website for me. Yes, it cost me money, but while it was being designed and built, I earned money doing stuff I can do!

The moral of the story is this: perhaps you can do your own bookkeeping, but consider what you are NOT doing while you are maintaining your own financial records!

If you want to have a free no-obligation chat with me about how I might be able to help you out with your bookkeeping requirements, get in touch.

Cash flow forecasting: do I need it?

29th June 2022

Cash Flow Forecasting: Do I Need It?

Profit and Cash Flow

You may already monitor your profit and assume that because you are profitable, you are cash-rich. Perhaps you are. Perhaps not..?

Accounting is like a dark art; it was created to make people who are not accountants think that accountants are wizards, because they can see things the ‘ordinary human’ can’t. Yes, you are making a profit and that’s brilliant! But wait, your wizard (accountant) has spotted something in your balance sheet (that mysterious area of accounting that wizards use to mystify non-wizards) suggesting you may not be doing as well as you think.

After you’ve had time to digest the information, you realise that you are making ‘£x’ profit each month, but your bank balance is remaining flat. It isn’t increasing in line with the profit you are making. Or worse, it is decreasing.

You ask your wizard to explain how this could be without using rabbits, hats and card tricks. They tell you that profit is like chalk and cash is like cheese. They are not comparable.

Profit (Chalk)

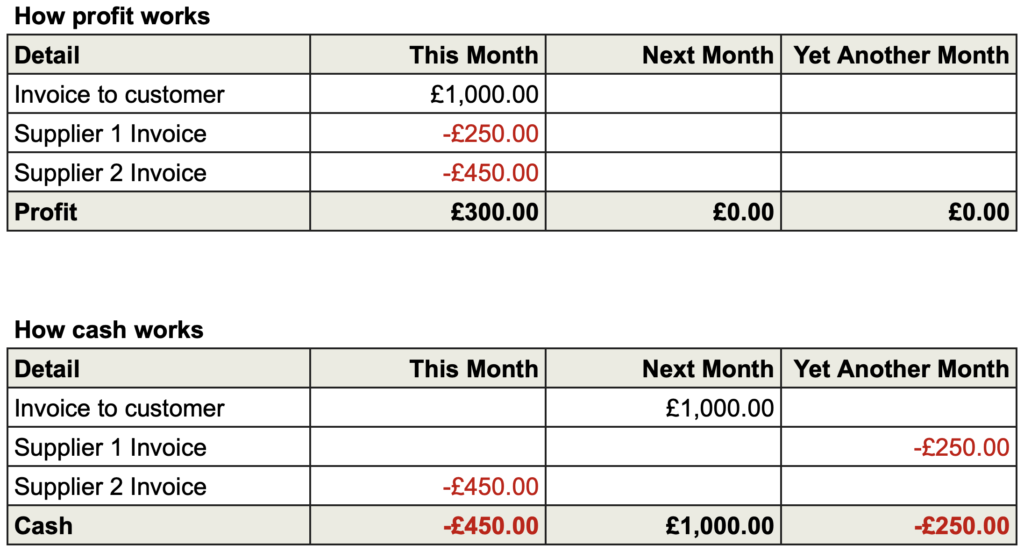

The things that go into making up your profit are things like sales invoices to customers, purchase invoices from suppliers, or expense claims from employees. The date of these transactions determines which period they impact your profit. They are NOT cash transactions (in most cases).

Cash (Cheese)

You have issued sales invoices to your customers. They may not pay you until the month after you issued the invoice. A disconnect between profit and cash.

You bought something from a supplier and they issued you an invoice for the goods/ service. You know you can get away with not paying them until two months after they invoiced you. But the other supplier you bought from, wants paying within a week of sending you the invoice! Differences between profit and cash.

Example

Using the information from the previous paragraph, I have painstakingly created an example of how the profit and loss would look and how your bank statement would look, if you only had those three entries. From a profit perspective, things look good. However, the bank account is fluctuating.

Other Influencing Factors

Besides what has already been mentioned, there are other influences on cash flow which are not usually present in the profit and loss statement. These include:

- Loan or hire purchase payments.

- Tax payments.

- Directors’ drawings or dividends.

- Fixed asset purchases.

- Stock held by the business.

- Debtors (the people/ businesses you sell to) not paying you on time.

- Creditors (who you own money to) may be pressuring you for cash before your customers pay you.

Cash Flow Forecasting: Why Do It?

- Knowledge – information and knowledge of your future cash position is vital to run a successful business.

- Peace of mind – with knowledge comes peace of mind. Even if things don’t look as good as you’d hoped, you can now act.

- Decision making – having a good cash flow forecast enables you to make decisions, some of which you can only make with confidence when using cash flow forecasting.

- Cash is king – as discussed earlier, profit doesn’t necessarily equate to a cash-rich company. Companies who don’t monitor their cash flow, no matter their size, can fail as a result.

How To Do It?

You could use the old traditional way of using a spreadsheet. Don’t get me wrong, I LOVE spreadsheets and you can have all sorts of fun with them. But to do justice to a cash flow forecast, you need a lot of spreadsheet skill and a good dose of time; not just to create it but to keep it up to date.

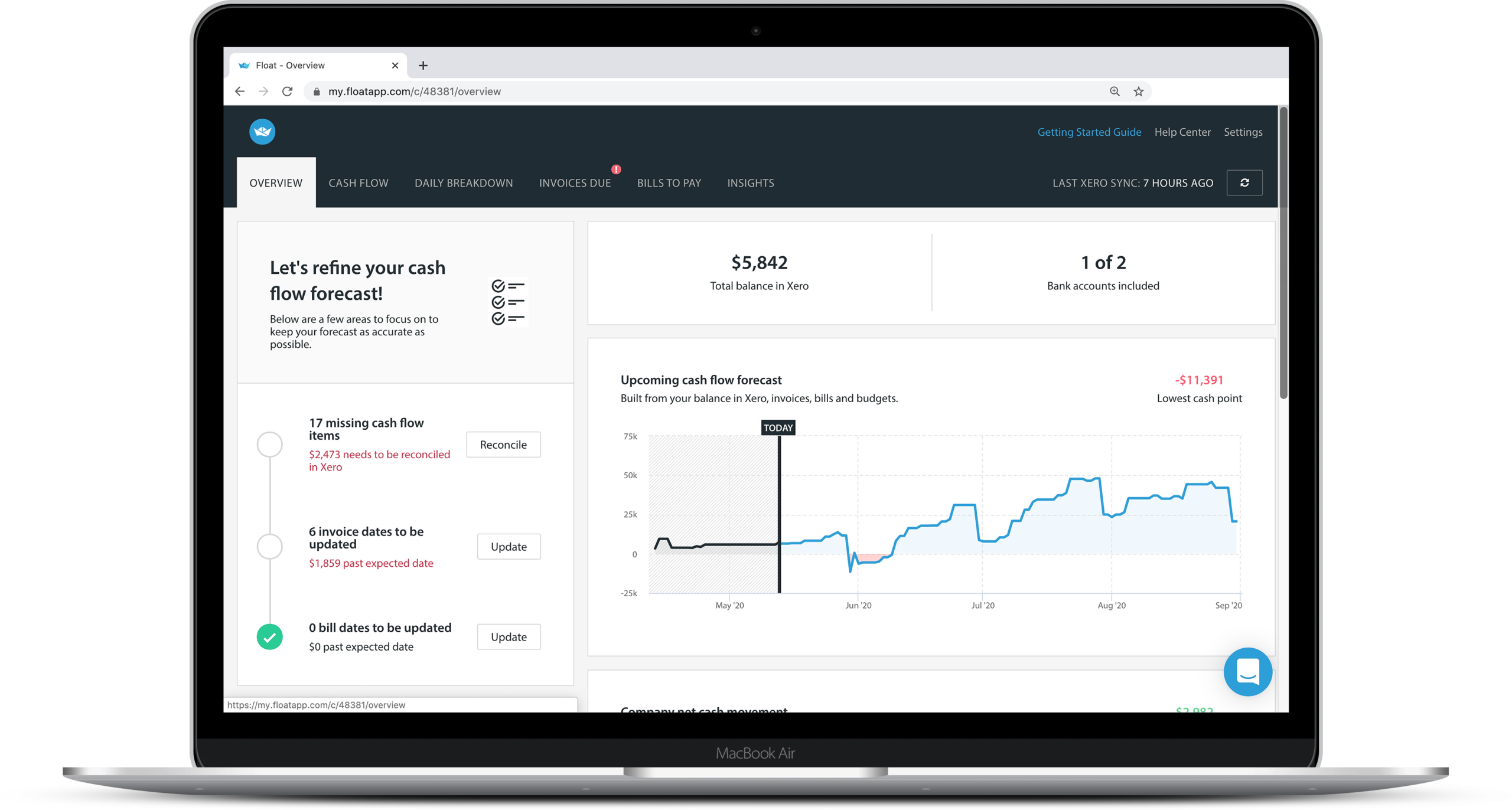

I use Float, a tool which links with Xero, QuickBooks or FreeAgent. To go back to my ‘wizard’ analogy, it is like a wizards’ assistant. It does a lot of the work for you and makes your life easier. You can do scenario planning with it and monitor your cash against budgets, too.

If you are interested in using Float or discussing cash flow forecasting further, please get in touch. It might just keep your business afloat (da-dum-tish).

Is data collection simply a habit?

29th June 2022

Personal data

I like to run. There’s a saying: “if it’s not on Strava, it didn’t happen”. In other words, if that run isn’t recorded (no data) then where’s the proof you did it? It can become obsessive, at least for me. In the course of over 5 years, I recorded at least one run every day. There was occasionally a panic because my Garmin (other sports tracking watches are available) was low on battery or wasn’t where I expected it to be. The panic existed because it meant I might not be able to record a run and that there would be no evidence of the run that day, and therefore my run streak would be broken, at least on Strava!

But there was more to it it than that. My Garmin records my heart rate, cadence, distance, speed and elevation. I can then add which pair of shoes I wore and therefore how many miles I had done in each pair. I can record how I felt, if it was a trail run, road run, a race or an effort session. Some more sophisticated (and expensive) running watches capture even more data; ground contact time, oscillation etc etc. My point is, every time I or any other runner with a Garmin (or any other kind of device to enable them to record their activity) steps out for a run, they are capturing a wealth of information about that activity. Cyclists do it too, swimmers and even those crazy triathletes do it! You can also record your golf session, your hike, your HIIT workout…

I realise that if you are not a runner, cyclist or golfist then I may be losing you right about now. “What’s he going on about” you might be thinking? Bear with me.

What is essentially a straight forward activity – a run – can provide a wealth of information about that simple activity. This information can be used! It can be a source of discussion and decision making, and you can learn from it, improve or simply continue being the best you can be…. I recorded at least 2,016 consecutive runs. That’s a lot of data. Did I use it to make decisions? Did I use it to help me improve my performances? Undoubtedly. But did I use 100% of that captured data? Definitely not. Maybe around 40-50%.

I know people who would shudder at that confession. Running coaches or really good runners who might (rightly) argue that you simply can’t make the right decisions without using far more that 40-50% of all that data. Decisions which would have helped me improve faster and make greater gains. But the fact remains, I was using the data I had collected to make improvements, to prevent injury by over-training, or simply to compare similar routes, distances or races. Simply having the data meant I could use the it for gain or to prevent problems from occurring. Without that information, perhaps I might have not managed a ‘run-streak’ as long as I did! (Many have done much longer run-streaks by the way).

Business data

So how is all this relevant to businesses? To your business? Or to you personally? I have listed one way in which I capture data and if I think about it, there are more (and they are not related to running). Because I own a business, I must capture financial data and keep proper accounting records. I might choose to store information about my clients, to help me in my marketing. If my business was a shop, perhaps I would record footfall, or the general age or gender of my customers. Whatever a business sells, there will likely be some sort of data stored somewhere about how many of each item or service were sold, when they were sold, how much for and to whom. Perhaps there is data about the interactions leading to each sale; where did the buyer hear from you? Have they purchased from you before?

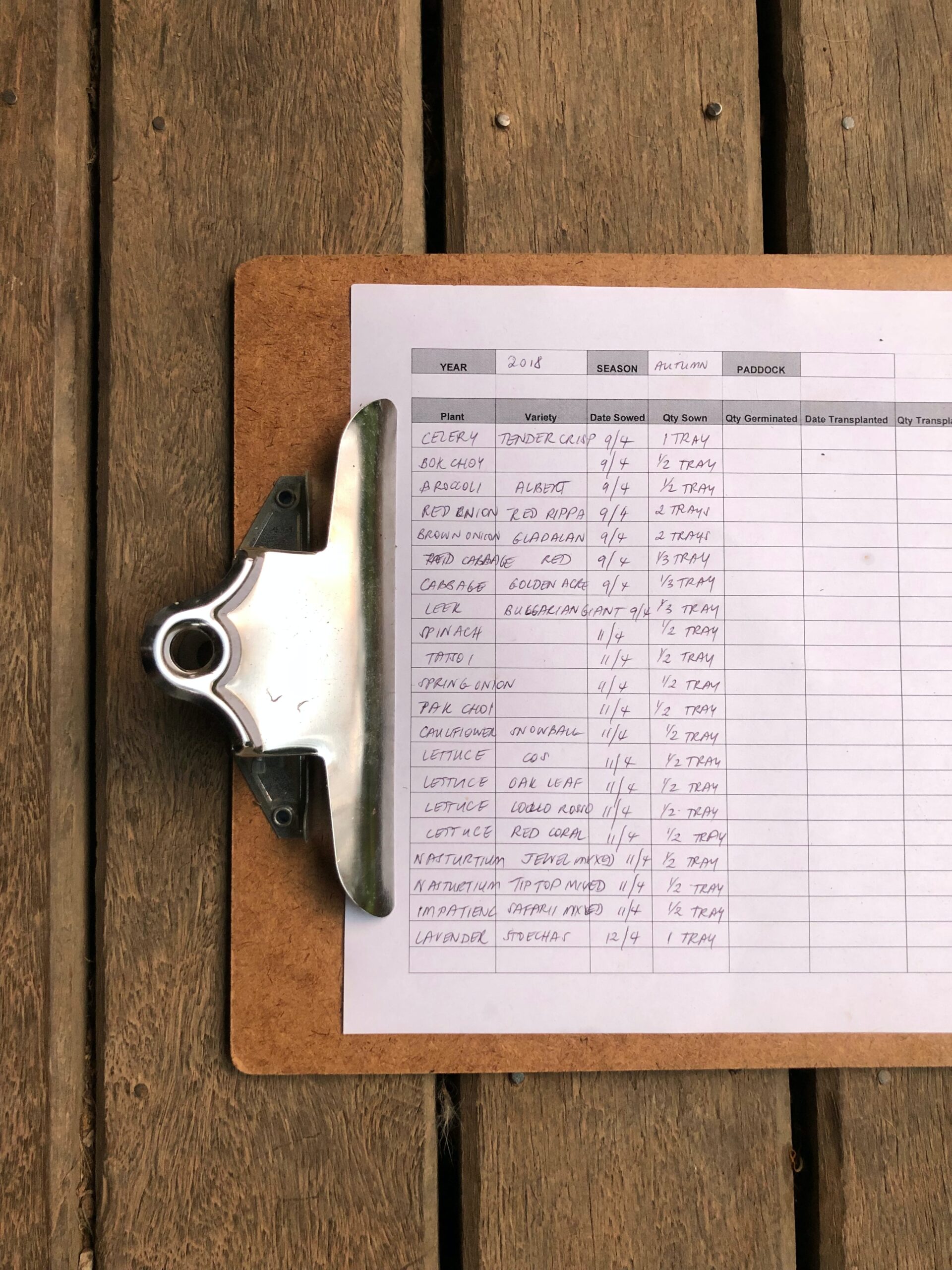

My point is that to one degree or another, the majority of businesses and many individuals, capture data. Sometimes this is a requirement, such as financial records. Sometimes it is because we can. Data can also be collected out of habit. Whatever the reason, if you think about it for a couple of minutes, you will probably come up with some ways in which you and/ or your business capture data.

Is it simply a habit?

Continuing the narrative regarding the data I capture on my runs, as I mentioned previously, I wasn’t analysing 100% of the data 100% of the time. The same scenario is likely to be true when you consider the data you capture. Maybe you are gathering the information and doing absolutely nothing with it? Yet you still continue to obtain it. Picture the scenario: a business owner and their employees are fastidiously collecting and recording information but never doing anything with it. Why? Habit? The sense that it will come in handy one day? Both are probably equally true. Maybe there was once a time when the data was analysed, but that has since stopped?

I recently read about ‘minimalist running’ (which is more than simply running in barefoot shoes or no shoes at all). To do minimalist running, you ditch the tech! You don’t record your distance, heart rate, cadence etc… Just writing about it makes me shiver, so I completely get why people continue to record data, even if there is seemingly no benefit at the other end. If you are in the situation where you are capturing data and never analysing it (and it’s not a legal requirement to capture it), perhaps consider the equivalent of ‘minimalist running’ in your situation. Does it make you feel liberated or cold and scared?

Stop doing it, or use it!

Maybe you would feel liberated by not obtaining and recording that unused information. Just take a moment to consider the consequences. If there are none you can think of, go ahead and stop doing it. Would you be able to use that time saved on something else? Probably. Would it simply make you a little bit happier each day? Probably. Don’t do something just for the sake of doing it, but the caveat to that is, you need to be really sure that you won’t look back on that decision and regret it.

- If the answer is cold and scared, then I would seriously consider looking at a way to analyse that wealth of information you have stored. If you don’t, it is a bit like me leaving the house and getting in the car each morning to drive 20 miles to work, when I work from home. It’s pointless. You may find that this solves your problem (do you go ‘minimalist’ or not), as the data you have may give you nothing of use.

- However, more likely you will have useful information to interrogate and provide you with answers. It might even increase your profit?